insurance and financial market awareness for lic aao | insurance and financial market awareness for lic aao pdf | insurance and financial market awareness book for lic aao | insurance and financial market awareness book for lic aao pdf | insurance and financial awareness for lic aao | insurance and financial market awareness for lic aao 2023 | insurance and financial market awareness pdf for lic aao | financial awareness pdf for lic aao | lic aao financial awareness | lic aao insurance and financial market awareness pdf | lic aao insurance and financial market awareness | lic aao insurance and financial market awareness book | Insurance and Financial Market Awareness For Lic Aao PDF in Hindi | Insurance and Financial Market Awareness For Lic Aao PDF Download

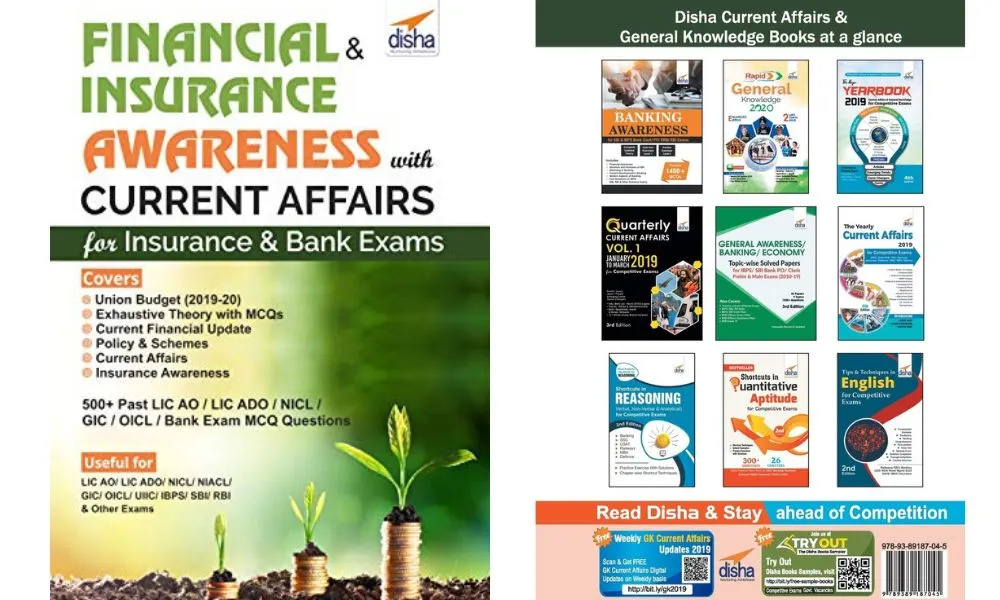

Insurance and Financial Market Awareness For Lic Aao PDF 2023

Insurance and Financial Market Awareness For Lic Aao PDF : In today’s rapidly changing world, having a comprehensive understanding of insurance and financial markets is crucial. It enables individuals to make informed decisions about their financial well-being and safeguard themselves against potential risks.

Read Also: Insta Millionaire Full Story PDF in Hindi – आपके करोड़पति बनने का राज़

This article aims to provide valuable insights into insurance and the financial market awareness required for LIC (Life Insurance Corporation of India) AAO (Assistant Administrative Officer) exam preparation. By familiarizing yourself with this topic, you can enhance your knowledge, increase your chances of success, and build a strong foundation for a career in the insurance sector.

Insurance and Financial Market Awareness For Lic Aao PDF (Summary)

What is Insurance?

Insurance is a risk management tool that provides individuals or organizations with financial protection against potential losses or unforeseen events. It entails paying an insurance provider a premium in exchange for protection. In the event of a covered loss, the insurance company compensates the insured party based on the terms and conditions of the policy.

Importance of Insurance

Insurance plays a vital role in safeguarding individuals, families, and businesses from various risks. It offers financial protection, peace of mind, and stability during challenging times. Insurance helps mitigate the impact of losses and provides support in rebuilding lives and businesses after unfortunate incidents such as accidents, natural disasters, or health issues.

Types of Insurance

1.1 Life Insurance

In the event of the policyholder’s passing, life insurance protects the beneficiaries financially. It ensures that dependents are financially secure and can maintain their lifestyle even after the policyholder’s demise. Life insurance policies come in different forms, including term life insurance, whole life insurance, and endowment policies.

1.2 Health Insurance

Health insurance covers medical expenses incurred by individuals due to illness or injury. It offers financial assistance for hospitalization, medical treatments, surgeries, and medication costs. Health insurance policies can be individual, family, or group-based, and they help individuals manage healthcare expenses effectively.

1.3 Property Insurance

Property insurance protects individuals or businesses against property-related losses, such as damage to buildings, homes, or possessions due to fire, theft, or natural disasters. It provides financial compensation to repair or replace the damaged property, minimizing the financial burden on the insured party.

1.4 Vehicle Insurance

Vehicle insurance provides coverage for automobiles against accidents, theft, or damage. It is mandatory in many countries and helps individuals protect their vehicles from unforeseen events. Vehicle insurance policies can include third-party liability coverage, own damage coverage, or a combination of both.

Understanding Financial Markets

Financial markets are venues for the trading of financial assets including derivatives, commodities, stocks, and bonds by both people and institutions. They facilitate the flow of capital and help in efficient allocation of resources. Understanding financial markets is essential for making informed investment decisions and managing personal finances effectively.

2.1 Stock Market

The stock market is where shares or ownership stakes in companies are bought and sold. It provides individuals with an opportunity to invest in the growth potential of businesses. Stock market investments can generate capital gains through price appreciation and dividends.

2.2 Bond Market

Debt securities are purchased and sold on the bond market. Bonds are fixed-income instruments issued by governments, municipalities, and corporations to raise capital. Investors who purchase bonds earn periodic interest payments and receive the principal amount at maturity.

2.3 Money Market

The money market is a short-term debt market where financial instruments with high liquidity and low risk are traded. It includes instruments such as Treasury bills, certificates of deposit, and commercial paper. The money market enables participants to meet their short-term financing needs.

2.4 Derivatives Market

The derivatives market involves trading financial contracts whose value is derived from an underlying asset. These assets can be commodities, currencies, interest rates, or stock indices. Derivatives provide investors with opportunities to hedge against risks or speculate on future price movements.

Role of LIC in Insurance and Financial Markets

LIC is the largest state-owned insurance company in India and has a significant presence in both insurance and financial markets. LIC offers a wide range of insurance products and services to cater to the diverse needs of individuals and businesses. It plays a crucial role in mobilizing savings and channeling them into productive investments, thereby contributing to the growth of the economy.

Insurance and Financial Market Awareness for LIC AAO Exam

To excel in the LIC AAO exam, candidates need to have a strong grasp of insurance and financial market concepts. The following topics are essential for insurance and financial market awareness:

3.1 Concepts and Terminologies

Candidates should be familiar with fundamental concepts and terminologies related to insurance and financial markets. These include terms like premium, policyholder, underwriting, claim settlement, stocks, bonds, mutual funds, and risk management.

3.2 Regulatory Framework

Knowledge of the regulatory framework governing the insurance and financial markets is crucial. Candidates should understand the roles and functions of regulatory bodies such as the Insurance Regulatory and Development Authority of India (IRDAI) and the Securities and Exchange Board of India (SEBI).

3.3 Insurance Products and Services

Candidates should have an understanding of different insurance products and services offered by LIC. This includes knowledge of life insurance plans, health insurance policies, pension plans, and annuity products.

3.4 Investment Strategies

Awareness of investment strategies is vital for LIC AAO aspirants. Candidates should be familiar with asset allocation, portfolio management, risk-return trade-offs, and investment analysis techniques.

3.5 Risk Management

Candidates should grasp the concept of risk management and its significance in insurance and financial markets. This includes understanding different types of risks, risk assessment, and risk mitigation strategies.

3.6 Current Trends and Developments

Staying updated with current trends and developments in insurance and financial markets is essential. Candidates should be aware of technological advancements, digitalization, emerging products, and regulatory changes shaping the industry.

Insurance and Financial Market Awareness For Lic Aao PDF Download in English 2023

Insurance and Financial Market Awareness For Lic Aao PDF Download in Hindi 2023

Conclusion

Insurance and financial market awareness are integral aspects of LIC AAO exam preparation. A strong foundation in these areas equips candidates with the knowledge and skills necessary for a successful career in the insurance sector.

By understanding insurance types, financial markets, and LIC’s role, candidates can navigate the exam with confidence. Continuous learning and staying informed about industry developments will contribute to their professional growth and success.

Read Also: Nilavanti Granth PDF Full – निळावंती ग्रंथ का रहस्य क्या है और भूल के भी न पढ़े